January 12th, 2023 by peacefulminds100

First, identify cases in which you delay unnecessarily, to figure out what exactly you procrastinate on (e.g., studying) andhow you do it (e.g., by browsing social media). Then, think about those situations to also figure out where and when you procrastinate (e.g., at home or the library, on starting or finishing tasks, in the morning or evening). Finally, figure out why you procrastinate (e.g., due to perfectionism, fear, anxiety, depression, ADHD, sensation seeking, or abstract goals), potentially after reading about why people procrastinate. Another great way to make tasks more achievable is to break them down. For example, consider the remarkable productivity of the famous writer Anthony Trollope.

If you already know what you need to do next based on what you’ve read, do that. This guide gave you the main tools you need to stop procrastinating; now, it’s up to you to use them. Practice mindfulness (by paying attention to yourself and your environment as they are in the present moment, while accepting your thoughts and emotions in a non-reactive and non-judgmental manner). For example, you can ask a close friend to check on your progress once a week, or find an accountability buddy to work with. For example, write down why an outcome that you’re pursuing is important to you. If this might be the case for you, then you should think through your situation to figure out what you’re afraid of.

What is Emotional Intelligence Coaching?

For example, you can How To Stop Procrastinating, Right Now down a list of upcoming tasks in a notebook or an app. Such network is comprised of people (e.g., friends and study partners) who can help you in various ways, like providing emotional support when you face your fears. For example, move the icon of your favorite social-media app (e.g., Reddit) away from your phone’s home screen, so you won’t see it every time you open your phone. This involves incorporating elements from games, like competition with others and the accumulation of points, into other types of activities.

What is the 2 minute rule?

It was first established by David Allen in his book, Getting Things Done. The two-minute rule aims to banish procrastination and help people accomplish small tasks. Here's what the rule says: if you can do an action in two minutes or less, tackle it at the moment — and don't delay.

You hung out with friends, went for a run, reorganized your closet, maybe even finished the assignments for all your other classes. You just really, really didn’t want to study for this test, and now you’re faced with a night of cramming. Working with an online life coach is easy, and can be even more effective than in-person coaching. Get the scoop on working with an online life coach. Connect with an expert Denver life coach to build healthy relationships, authentic happiness, and create success. We have offices in Denver, Broomfield, and DTC.

How to Stop Procrastinating Right Now

This will deal with the intimidation factor, and you’ll likely spend much longer than 15 minutes on your task before you stop working again. If you are having difficulty staying on track with your goals, seeking professional assistance may be the best course of action for you. A therapist can help you understand how your habits and thoughts are affecting your success and help you develop new habits that will help you achieve your objectives. A therapist can also help with setting realistic goals and goal-setting strategies, as well as practical advice on how to achieve them. To kind of have this mental jujitsu where you can help yourself stay focused on the one small task that would bring some value in the short term, and it would make things better than they currently are.

- This will help make things less overwhelming, and make it seem easier to complete each task individually.

- By changing or finding a better environment, you focus more on what’s in front of you.

- Would you like to get the feedback and recommendations of a professional life coach ASAP?

- Doing this can also help with other things, like creating your action plan.

During our more productive moments, when we temporarily figure out how to stop procrastinating, we feel satisfied and accomplished. Today, we’re going to talk about how to make those rare moments of productivity more routine. Don’t make the mistake of equating frictionless work with productivity. Diverse teams, for example, often generate better ideas but can experience more tension.

But don’t create tasks so challenging that they’re not reasonable.

Rewarding yourself is an integral part of overcoming procrastination. By rewarding yourself for completing tasks, you give yourself a reason to stay on task, and it feels good. Set a deadline for each portion of the job when breaking down activities. This will assist you in staying on track and avoiding procrastination by setting deadlines for each chunk.

Some people do not understand how individuals with schizophrenia think, feel, or act. Let us look into the beautiful minds of people with schizophrenia. Some people find this technique to be very effective when studying or working. Plus, the 10-minute breaks ensure you won’t easily get burned out or drained. Procrastinating every day can also annoy the people around you. Who wants to be around someone who spends most of their time goofing around?

Keep in mind that your work space affects your productivity …

Tackle things as they arise, rather than letting them build up. Even if it’s just replying to an email to explain your current timetable and availability, take small actions each day. Even if it’s something small, like half an hour reading a book in your favorite coffee shop, promise yourself a treat once you’ve tackled an unpleasant task. If you find yourself repeatedly waiting for the ‘right’ moment to tackle a task, or expecting to suddenly find yourself in the ‘right’ frame of mind, you might never get it done. Set yourself a time to start a task, and stick to it. It can be easy to assume that procrastinators are simply work-shirkers, but that’s often far from the case.

May 21st, 2022 by peacefulminds100

Personal property and real estate taxes are both paid at the state or local levels. Property taxes and real estate taxes both refer to levies on immovable property, also known as real property. Unless you’re a real estate tax law rock star , you should plan on working with someone who is. Find a trusted tax accountant or CPA to guide you through the process of buying, operating, and selling investment property.

Property Taxes Are Going Up; Here’s How to Lower Your Bill – The Wall Street Journal

Property Taxes Are Going Up; Here’s How to Lower Your Bill.

Posted: Sun, 05 Feb 2023 13:30:00 GMT [source]

You can find the mill levy on your local tax assessor’s website as well. The tax return is filed in the prescribed documentation depending on whether it is an individual or a legal entity.

How Real Estate Taxes Work

However, if your Class 2 property is assessed at, for example, $5,500,000, your tax is computed using the $1.77 tax rate. That product is $97,350, which is the annual tax on the property’s $5,500,000 assessment. Assessed value is a percentage of the market value as determined by the assessor’s office. In order to calculate the assessed value, multiply the market value by the appropriate assessment rate for the type of property. The real estate tax rate is $1.18 per $100 of assessed value.

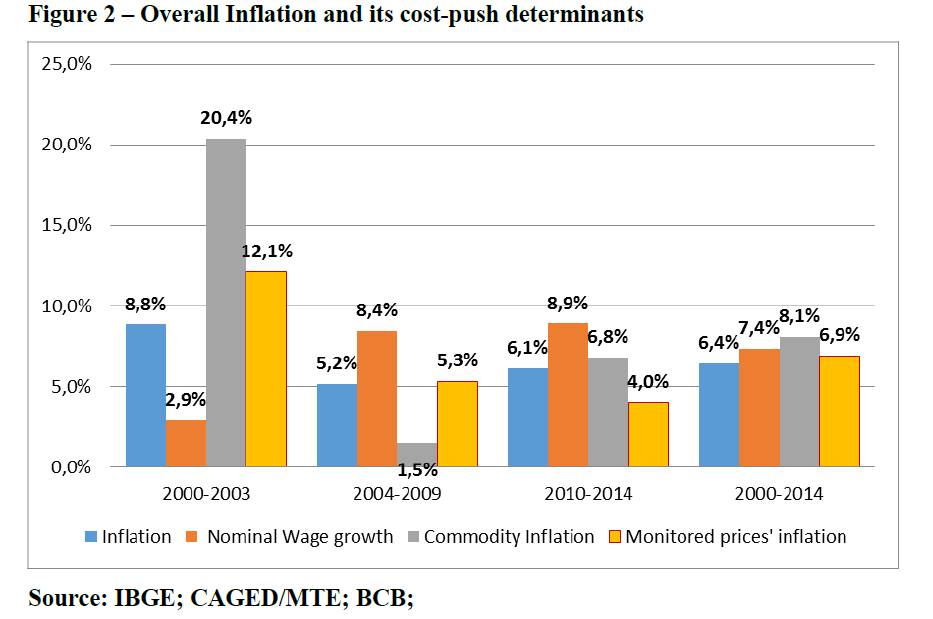

Brazil is a Federation Republic, and its federated entities , as well as the Federal government, levy property taxes. General government revenue, in % of GDP, from property taxes. This rate alone determines 44% of the international variation in PPP GDP per capita. In most Organization for Economic Co-operation and Development countries, immovable property tax represents a low proportion of federal revenue when compared to income taxes and value-added taxes.

Real Estate Taxes vs. Property Taxes

“Toronto has the lowest property tax rate among 35 major Ontario cities, a new study says”. An assessor is a local government official trained to determine the fair market value of property for local taxation purposes. A transfer tax is a charge levied on the transfer of ownership or title to property from one individual or entity to another. Property tax is based on the value of the property, which can be real estate or—in many jurisdictions—also real estate taxes tangible personal property. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting. Let’s say your house has a fair market value of $350,000 and the predetermined percentage in your municipality is 65%, the tax assessment value of your home is $227,500, or $350,000 x 65%. Religious organizations, like churches, are usually not taxable.

It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; See Guarantees for complete details. If you need help navigating property taxes, check out our informative state content posts, which cover state-by-state the property tax requirements, rates, and laws. Items not subject to personal property tax include intangible personal property; some jurisdictions may tax certain business personal property items but not the equivalent personal use items. The tax assessed value for every home is public record and therefore accessible to anyone who wants to know it.

The United States

The assessor’s primary responsibility is to find the fair market value of your property. Assessments are determined prior to the County’s budget and tax rate approval. For businesses that are required to pay these taxes, personal property might also include equipment, appliances, furniture, and tools. Personal property taxes are levied on movable assets, such as cars and boats. Additionally, this new tax law limited the “state and local tax” deductions to $10,000 per year.

- As of 2021 the initial national central rate of the tax is 0.18% of a property’s value up to €1 million.

- If you have a mortgage, it’s usually part of your payment.

- In medieval Europe, property taxes were based on the size of a piece of land.

- Every local government has its own real estate property tax procedures.

But if you’ve never owned real estate or your own business, you may not know how real estate property taxes work. Mobile homes are usually considered real property when the wheels are removed, they’re permanently fixed to a foundation, and you own the land beneath them. In this case, a mobile home would be subject to real estate taxes rather than personal property taxes. Depending on your tax situation, you may be able to deduct some or all of your real estate taxes and personal property taxes.

Find The Assessed Value Of The Property

If you believe your home’s most recent appraisal is too high, you may be able to file an appeal for a small fee. If you earn income during the year, you are required to report it on your tax return. That includes money from paychecks, bank interest, investments, and more. Even though your house is considered an asset, it doesn’t count as actual income and is taxed separately as real property. Again, be sure to pay your personal property taxes on time. “Failing to pay or report tangible property can lead to fines and liens against the property,” Williams said. Another way to think about this is to understand that real estate tax (i.e., property tax) is based on just that — real estate.

Generally, these taxes are paid at the state or local levels, but some areas do not require taxes to be paid on personal property at all. While taxes for homeowners can be relatively simple, taxes for real estate investors are tricky. The taxes covered here are the ones you’ll likely encounter as a real estate investor. Still, you may owe other taxes, and you may be eligible for other tax benefits, depending on your situation. A Section 1031 exchange (also called a like-kind exchange or a Starker) is a swap of one investment property for another. In simple terms, you sell one property and buy another “like-kind” property with the proceeds. If you sell a rental property, depreciation will play a role in how much tax you owe.

Rocket Mortgage

One city uses property tax revenue to repair roads riddled with pot-holes, while another city uses the revenue to hire more police officers to fight a gang problem. Real estate taxes are annual taxes a homeowner must pay on the assessed value of their house. Ever hear people complain about the high cost of real estate taxes in their area? This is what they’re referring to, and higher tax rates are often found in large cities like New York or Los Angeles. They are levied on most properties in America and paid to state and local governments. The funds generated from real estate taxes are typically used to help pay for local and state services.

Are Florida real estate taxes high?

Looking at the average total property tax millage rates in 2021 published by Florida Tax Watch, the highest rates were paid in St. Lucie, Alachua, Broward, and Duval counties. The highest per capita total property tax levies were Monroe ($3,435), Walton ($3,289), and Collier ($3,081) counties.

November 2nd, 2021 by peacefulminds100

An inability to select a meaningful measure of asset usage may indicate that MUP depreciation is either inappropriate or impractical and instead, another method should be used. Straight-line depreciation is based on the premise that depreciation of a productive asset is a function of time, not usage. Units-of-production depreciation is based on the premise that depreciation of a productive asset is a function of usage, not time.

Its main disadvantage is that it is difficult to apply to many real-life situations, as it is not always easy to estimate how many units an asset can produce before it reaches the end of its useful life. Sum of the years’ digits depreciation is similar to the double-declining method in that it is also an accelerated depreciation calculation. Instead of decreasing the book value, SYD calculates a weighted percentage based on the asset’s remaining useful life. There are several methods that accountants commonly use to depreciate capital assets and other revenue-generating assets.

What Assets Cannot Be Depreciated?

For example, at the beginning of the year, the asset has a remaining life of 8 years. The following year, the asset has a remaining life of 7 years, etc. Consider the following example to more easily understand the concept of the sum-of-the-years-digits depreciation method.

An https://1investing.in/ is property you acquire to help produce income for your business. Get access to a dedicated business tax expert, with unlimited year-round advice, at no extra cost. MACRS is a depreciation system allowed by the IRS for tax purposes. Finally, by allocating expenses properly, businesses can make more informed decisions about future investments. Depreciation comes from several factors, including the age and type of the asset, how long it serves its purpose, and the asset’s condition at acquisition. Generally speaking, assets that are used more often or are in better condition depreciate faster than assets that are used less often or are in worse condition.

For example, purchasing the $135,000 tractor will require that the dealer be paid immediately even though the 15,000 hours of useful life may be spread over 5 to 20 years. Thus the cash outflow to purchase the tractor does not align with when the depreciation will be recognized and subtracted as a cost. If the owner’s assets are employed for business and personal use, then the portion of the asset used for business purposes is eligible for depreciation. For example, when a vehicle is employed 60% for business purposes, then depreciation can only be claimed for 60% of the cost of the vehicle. Assume in the earlier Kenzie example that after five years and $48,000 in accumulated depreciation, the company estimated that it could use the asset for two more years, at which point the salvage value would be $0.

How Do Depreciable Business Assets Work?

When the asset is no longer useful to the company, the company may sell it off at a lower price than what it was initially worth. Knowing what can and cannot be depreciated in a year will help business avoid high front-loaded expenses and highly variable financial results. Debit ($)Credit ($)Accumulated Depreciation — Machinery80,000Machinery80,000Besides disposal, individuals must know how to record the sale of a depreciable business asset. One can follow these steps to compute the gains or losses generated upon the sale of an asset. As noted above, companies must begin depreciating assets once they place them into service. One must remember that the business does not have to use the asset, but the property cannot sit idle inside an unopened box.

IRS Form 4562 Explained: A Step-by-Step Guide – The Motley Fool

IRS Form 4562 Explained: A Step-by-Step Guide.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

You then take this figure and divide it by the useful process costing of the property. The useful life will vary depending on the depreciation method employed. The best way to determine which assets can be depreciated and which cannot is by considering factors such as the type of asset, its current value, and estimated useful life. Generally speaking, assets that are permanent or have an indefinite useful life will not be depreciated. Other criteria include whether the asset was created for business use or is held for investment purposes, its expected future usefulness, and applicable industry standards. Examples of depreciable assets include electronics, furniture, automobiles, etc.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

The remaining basis of the asset then is depreciated by one of the other applicable methods. This method could also be applied in terms of acreage; for example, a machine that has an expected life of 16,000 acres and cost $240,000 would have an depreciation expense of $15 per acre of use (240,000/16,000). This depreciation cost per acre can then be used to allocate cost of the machine among enterprises and production periods. To simplify the procedure, the calculations are often based on time; for example, some methods of depreciation allocate a portion of the cost of the machine to each production period during which the machine will be used. This alternative should provide the business manager with better information, that is, a more accurate measure of the cost to operate the business, and thus the profit generated by the business during each production period.

Capital gains are subject to federal income taxes at varying rates, usually lower than ordinary income tax rates, but they are not taxed as self-employment income. Perhaps the most frequent application of depreciation is in calculating the business net income (profit?) for purposes of determining the amount of income tax owed by the business or its owners. However, the depreciation allowance for income tax purposes is not likely to reflect the actual use of the machine. Accordingly, it is a common recommendation that businesses maintain two depreciation schedules — one that complies with income tax law and one that more accurately allocates the cost of the machine over its useful life. Depreciation and amortization are similar; both are non cash expenditure and reduce the company’s profits.

There are many nuances and rules regarding the Section 179 deduction, and it’s always wise to seek the assistance of an accountant or tax professional. The kinds of property that you can depreciate include machinery, equipment, buildings, vehicles, and furniture. You can’t claim depreciation on property held for personal purposes. If you use property, such as a car, for both business or investment and personal purposes, you can depreciate only the business or investment use portion.

Create your free account now

When an asset is first purchased, it may not be used immediately or generate income right away. However, over time, that asset will contribute to the bottom line and must reflect the actual cost in the financial statements. Companies use depreciation to record the declining value of an asset on the balance sheet. In many countries, businesses can deduct depreciation costs when calculating their income taxes.

Depreciation is the process of deducting the cost of a business asset over a long period of time, rather than over the course of one year. As such, the company’s accountant does not have to expense the entire $50,000 in year one, even though the company paid out that amount in cash. Instead, the company only has to expense $4,000 against net income.

Which Asset Cannot be Depreciated in a Business?

This is done by taking the asset’s original purchase price and dividing it by the number of years in its useful life. This method is used to generate an annual expense to offset revenue. On January 1, 20X1, Telecom Co purchased 1,000 new telephone poles for $100,000 , each with an estimated useful life of five years (annual rate of deprecation of 20%).

2021 Instructions for Form FTB 3885 Corporation Depreciation and … – Franchise Tax Board

2021 Instructions for Form FTB 3885 Corporation Depreciation and ….

Posted: Sun, 06 Feb 2022 11:57:10 GMT [source]

What if, for a single purchase price, you purchase an asset that is only partly depreciable? Before you can determine the depreciable tax basis of the asset, what you need to do is to allocate the price between the depreciable part and the non-depreciable part. Mannequins are long-term tangible assets of a clothing boutique which is why they are depreciable in its accounting books. In accounting, cash is considered a depreciable asset because its future worth is reduced because of inflation.

- As a result, your depreciation is also based on six months in the first year.

- In this example, because the equipment is expected to have a ten-year useful life, the digits 1 through 10 are added together (i.e., 1 + 2 + 3, etc.) to determine the denominator of 55.

- This change will allow businesses to deduct 100% of the cost of eligible property in the year it’s placed in service.

A deductible expense of $1 will never reduce income tax by $1, nor will a taxable income of $1 increase income tax by $1. The change in the income tax will only be a portion that reflects the tax rate, perhaps $35%. A depreciable asset is an item that is used in more than one production period but will not last forever. Depreciation for purposes of management can be described as a procedure to allocate or assign a portion of the cost of an asset to each production period during which the asset is used. In managing depreciation for tax purposes, the manager will strive to make decisions, as allowed by federal income tax law, to maximize the business’ after-tax income.

What is an Asset’s Useful Life? Learn More – Investment U

What is an Asset’s Useful Life? Learn More.

Posted: Mon, 01 Nov 2021 07:00:00 GMT [source]

This means they can take a tax deduction for the cost of the asset, reducing taxable income. But the Internal Revenue Service states that when depreciating assets, companies must spread the cost out over time. Businesses can ensure accurate financial statements and more favorable tax treatment by selecting the suitable depreciation methodology for their assets.

September 30th, 2021 by peacefulminds100

Raw materials are commodities companies use in the primary production or manufacturing of goods. Investopedia requires writers to use primary sources to support their work.

- How a business depreciates an asset can cause its book value to differ from the current market value at which the asset could sell.

- By reducing the taxable earnings, depreciation reduces the amount of taxes owed.

- They are not sold to customers or held for investment purposes.

- There has to be a disclosure of any change in the value of assets due to revaluation.

A standard project template which follows the typical componentization of a Building AuC (where the final assets are the sub-components) exists in the system. To use this as a starting point for your AuC, follow the instructions directly below, otherwise look at the section on creating a project from scratch.

Best practices for fixed asset accounting

However, personal vehicles used to get to work are not considered fixed assets. Additionally, buying rock salt to melt ice in the parking lot would be considered an expense and not an asset at all. Noncurrent assets, in addition to fixed assets, include intangibles and long-term investments. You can generate several fixed asset accounts to accommodate equipment, machinery, land, and vehicles. This refers to the initial acquisition of any type of fixed asset.

The decision of the depreciation method should be based upon the consumption of the economic benefits of the asset by the organization. The valuation of the asset is the Fixed Asset Accounting: Overview fair value less its subsequent depreciation and impairment. To meet these needs, FinancialForce works with a thriving ecosystem of partners that complement our solutions.

Retirement without Revenue

To avoid such scenarios, classify your assets according to their use, durability, and expected life. Then, determine the best possible depreciation method on the basis of the unique attributes of these distinct groups.

Businesses use fixed assets for construction projects, equipment, and office furniture. Fixed assets are used for non-income-generating purposes such as storing inventory, producing products, and providing services. Fixed assets are items of tangible property used to produce income or generate revenue for a business.

2 Fixed Assets Features

Assets can be acquired in following ways; as a standalone asset, asset under construction or through donation. The following sections describe the Umoja processes for each acquisition method, starting with the process for standalone purchased of assets. This flexibility is helpful as many companies delay processing fixed asset information https://business-accounting.net/ until they are ready to compute period depreciation. For example, you can use the Fixed Assets system’s automated asset setup to update asset information on a daily, monthly, quarterly, or annual basis. Information about a corporation’s assets helps create accurate financial reporting, business valuations, and thorough financial analysis.

In the window that opens, select /ZPOSTVALto change the layout to show a different set of columns, sorts, and filters. Click on the Get Variant button and then select the variant called Z_AUC_ASSET.

March 1st, 2021 by peacefulminds100

An organizational chart, also known as an organogram, is a diagram that outlines your team structure and shows the reporting relationships between team roles. The organizational chart is a one-dimensional document, so it doesn’t offer much explanation beyond the reporting structure it provides. While it’s useful in visualizing the basic company structure, it only shows formal relationships. Many companies function and thrive on various informal reporting relationships that wouldn’t show up on a traditional org chart.

How the UK Health Security Agency’s misleading data fuelled a … – Full Fact

How the UK Health Security Agency’s misleading data fuelled a ….

Posted: Fri, 05 Nov 2021 07:00:00 GMT [source]

The entrepreneur wants to satisfy the needs of a niche of customers innovatively, especially when compared to others in the marketplace. Divide up the work according to what the business needs. If that person leaves, you’ll have to start all over with a new chart because you won’t be able to find an identical candidate to replace them.

How to create an organizational chart (with free templates)

For each task, documentation should provide the purpose, steps, and standards for the process and result. Understand that “the true product of the business is the business itself,” and the customer is the franchisee. Businesses in infancy are characterized by the owner and business being synonymous. You dedicate many personal resources to it, but it takes its toll. This stage ends when the owner understands that they can’t run the business this way forever and need help to learn and grow.

It’s aimed at entrepreneurs and business owners, but it’s also very useful for anyone leading a team. As I complete the work for that role, I’ll start documenting the processes and procedures I go through to get that specific type of work done. In the second scenario, he explains that when they start taking accountability for specific roles, things fall into place. They create a full list of “jobs” and responsibilities for each job. A divisional organizational structure is a high-level version of the traditional hierarchical structure. Divisional structures make sense for companies that have departments working independently from one another.

Your organization chart is a visual diagram or graph depicting your company’s organizational strategy. It helps you objectively see the functions, positions and responsibilities you need in your business so you can create a strategy for how it operates. The right strategy is to help you systematize your own way of operating the business without you holding all of the functions within it. If you routinely struggle with this type of confusion and underperformance among your employees, it’s a sign that the functions of your business are tied topeople, not systems. And with the right strategy, the structure of your business could be positioned to operate without you holding all of the functions within it.

Building an Org Chart

People switch in and out of positions and reporting relationships may also change. With a digital org chart, it’s easy to update the structure and redistribute it to team members. Deciding how to build your organizational chart is crucial because different tools can make the process easier. Drawing out your org chart by hand isn’t time efficient and will make your results hard to share, so consider harnessing the power of a tool for this process.

I hope The E-Myth Revisited summary has inspired you to get your copy of the book. For more on how to implement an operating system in your business, check out Traction . For a book on incorporating entrepreneurship into your life, check out The EOS Life . You hire technical help who has experience in your type of business, and it goes well at first.

Business Coaching Service Market to Witness a Pronounce Growth During 2023-2031 Small BusinessCoach Tony Rob – openPR

Business Coaching Service Market to Witness a Pronounce Growth During 2023-2031 Small BusinessCoach Tony Rob.

Posted: Wed, 15 Mar 2023 07:00:00 GMT [source]

However, you later find that your employees are not as dedicated as you are and work is not getting done as you would like. As a result, you believe that you will produce the best work, sideline your employees, and insert yourself back into the technician role. The perpetuation of the E-Myth is why many small businesses fail today. You should understand the E-Myth and apply it to start and grow a successful business]. The E-Myth Revisited was an easy read; and there’s plenty that I left out about managing people, validating businesses and measuring results.

Since you already have corporate experience, why start a Business consulting?

The flat organizational chart is unique because it shows few or no levels of management. This type of organizational structure may be present in a small business or a modern business that’s experimenting with no chain of command. While organizational charts can increase communication among teams, there are limitations of using them. Knowing these limitations can help you find solutions to any potential issues before they occur. With this type of organizational structure, the company promotes wide-spread team member self-management and decision-making.

While there are limitations to organizational charts, these charts offer a helpful way to understand your company structure. It can also improve communication with upper management by clarifying roles and responsibilities. To build an organizational chart for your company, use our free editable PDFs and customize them as you see fit. Giving two or more managers the power to direct the activities of one employee is an invitation to miscommunication and chaos.

I hope it is going well, its hard work but it’s nice when it clicks and makes you smile. That is definitely a case of a positive visualisation of a future event and then breaking it down it to steps. An onboarding type checklist that includes software to download, tools we use, etc. When something goes wrong with the books and they’re $1,000 short – they have no one to blame, because no one was held accountable for any specific thing. Find out how Asana helps teams communicate effectively.

An quickbooks self employed chart is a way to visualize your company’s structure. To create an org chart, you’ll need to gather team member information and decide how you’d like to build the chart. Ensure that every position on the chart reports to one manager. Giving two or more managers the power to direct the activities of one employee is an invitation for miscommunication and chaos.

Define Your Way of Doing Business by Dallas Romanowski … – Greater Wilmington Business Journal

Define Your Way of Doing Business by Dallas Romanowski ….

Posted: Wed, 01 Oct 2014 07:00:00 GMT [source]

“The business is a place where everything we know how to do is tested by what we don’t know how to do, and that the conflict between the two” creates growth and meaning. You should manage by creating and executing work in an Operations Manual. Within it, each role should have checklists to itemize the steps that your employees need to do their work, hold them accountable, and standards for performance. For more regarding checklists, check out The Checklist Manifesto . In the E-Myth Revisited, Michael Gerber states to set appropriate standards to help your people be more productive and deliver consistently.

The Turn-Key Revolution has changed how business is done, who goes into it, how they do it, and how likely they will survive. Reflect all of your business systems, stated in terms of the results they reach.

It’s easier to run through tasks for a lower, more “technician” type role than it is for the higher ones that involved leading people. There are four common org chart types and each one represents a different way that a company might function. You can use the organizational chart templates below as jumping-off points. To create your custom org chart, start by downloading one of the templates below that best represents your company structure. Then, fill in the labels to fit your unique team needs.

Running a business requires successful execution of these 3 roles. Once I go to hire someone, I can then pass off these process documents to them and they will become responsible for making sure the tasks get done. I’m getting ready to hire my first employee/partner/person in early 2018, so this chapter really opened my eyes. He goes on to share an example of two friends who go into business together.

- If that person leaves, you’ll have to start all over with a new chart because you won’t be able to find an identical candidate to replace them.

- Creating a culture so strong that even if the founder leaves, team norms and behaviors stay intact.

- Our guide—complete with a sample chart and template—will help you get started.

After all, it’s likely that your company structure and team dynamics will change often. You can treat your organizational chart like any other new project you work on. Defining the scope of your org chart can help ensure it clearly represents your team structure. The scope will determine the overall purpose of your organizational chart. A “Game Worth Playing” provides the purpose, values, and standards to live life well and perform at work.

October 24th, 2019 by peacefulminds100

CASH FLOW / CURRENT PORTION OF LONG TERM DEBT is a measure of the firms ability to meet its obligations with internally generated cash. An example of long-term debt is a loan that will be repaid in a year or more. Therefore, you need to be careful when calculating long-term debt. This is a function of time; that is, the longer the memory stays in the short-term memory the more likely it is to be placed in the long-term memory.

Is current debt the same as total debt?

Total debt refers to the sum of borrowed money that your business owes. It's calculated by adding together your current and long-term liabilities.

On a https://intuit-payroll.org/ sheet, a current portion of any long-term debt gets listed separately. This provides a better picture of a company’s current liquidity. Examples of long-term liabilities include bonds payable, long-term loans such as mortgage loans, and pension obligations. Only the portions of each that are due in more than 12 months are considered a long-term liability.

Analyzing Long-Term Liabilities

The fastest, smartest and easiest way for trucking companies to get paid. For example, debt due in five years may have a portion due during each of those years. Each such portion would be considered current portion of long-term debt. This is because there are fewer commitments through debt service providers. Capital injections from shareholders.For example, a company might issue new shares.

- In financial modeling, it may be necessary to produce a full set of financial statements, including a balance sheet where the current portion of long-term debt is shown separately.

- For example, if a company owes a total of $100,000, and $20,000 of it is due and must be paid off in the current year, it records $80,000 as long-term debt and $20,000 as CPLTD.

- The CPLTD is an important tool for creditors and investors to use to identify if a company has the ability to pay off its short-term obligations as they come due.

- The current portion of long-term debt is the amount of principal and interest of the total debt that is due to be paid within one year’s time.

- One important thing to note is that not all long-term liabilities are debts, although most of them are.

In this case, the amount due automatically converts from long-term debt to CPLTD. The current portion of long-term debt is the portion of a long-term liability that is coming due within the next twelve months.

Crash Course in Accounting and Financial Statement Analysis, Second Edition by Matan Feldman, Arkady Libman

To illustrate how businesses record long-term debts, imagine a business takes out a $100,000 loan, payable over a five-year period. It records a $100,000 credit under the accounts payable portion of its long-term debts, and it makes a $100,000 debit to cash to balance the books. At the beginning of each tax year, the company moves the portion of the loan due that year to the current liabilities section of the company’s balance sheet. Long-term debt’s current portion is the portion of these obligations that is due within the next year. In this example, long-term debt’s current portion would be $1,000.

ATN Reports Fourth-Quarter and Full-Year 2022 Results; Provides Guidance and Outlook – Marketscreener.com

ATN Reports Fourth-Quarter and Full-Year 2022 Results; Provides Guidance and Outlook.

Posted: Wed, 22 Feb 2023 21:36:01 GMT [source]

You repay long-term liabilities over several years, such as 15 years. Moreover, you can save a portion of business earnings to go toward repaying debt.

What is Current Portion of Long-Term Debt (CPLTD)?

This time the company has pushed the deadline to the end of April 2017. It tracks the current portion of debt vs. non-current portion debt of Exxon for the past five years.

In the Current Portion Of Long Term Debt Definition sheet, $200,000 will be classified as the current portion of long-term debt, and the remaining $800,000 as long-term debt. For example, if the company has to pay $20,000 in payments for the year, the long-term debt amount decreases, and the CPLTD amount increases on the balance sheet for that amount. As the company pays down the debt each month, it decreases CPLTD with a debit and decreases cash with a credit. The CPLTD is separated out on the company’s balance sheet because it needs to be paid by highly liquid assets, such as cash.

Short-Term and Working Memory

Here, the lessee agrees to make a periodic lease payment to the lessor. This is in exchange for the use of an asset, such as equipment. Keep in mind that long-term liabilities aren’t included with tax liabilities. Read on as we take a closer look at everything to do with these types of liabilities, such as how you calculate them, how they’re used, and give you some examples. Companies will have a number of financial obligations and business owners will know how important it is to keep a track of these obligations.

- Businesses classify their debts, also known as liabilities, as current or long term.

- Its repayment worth $1,000 is to be made by the company within a year and the remaining amount is to be paid in 4 equal yearly instalments in the subsequent years.

- Assets are resources owned by an entity that has economic value.

- Long-term debt is anything beyond the 12-month payment time frame.

- Accounts ReceivablesAccounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment.

- Consolidated Adjusted Debt means, at any time, the sum of, without duplication, Consolidated Funded Indebtedness and the product of Consolidated Rents multiplied by 6.0.